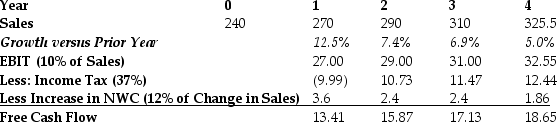

Use the table for the question(s) below. FCF Forecast ($ million)  Banco Industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 5% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. If Banco industries has a weighted average cost of capital of 11%, $50 million in cash, $80 million in debt, and 18 million shares outstanding, which of the following is the best estimate of Banco's stock price at the start of year 1?

Banco Industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 5% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. If Banco industries has a weighted average cost of capital of 11%, $50 million in cash, $80 million in debt, and 18 million shares outstanding, which of the following is the best estimate of Banco's stock price at the start of year 1?

Definitions:

Q25: A company issues a ten-year $1,000 face

Q28: Which of the following statements is FALSE?<br>A)

Q39: Valuation models use the relationship between share

Q54: Your estimate of the market risk premium

Q56: The above screen shot from Google Finance

Q74: Which type of investment has historically had

Q96: While _ seems to be a reasonable

Q106: Investors demand a higher return for investments

Q113: Consider the following two projects: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg"

Q123: Assuming that your capital is constrained, what