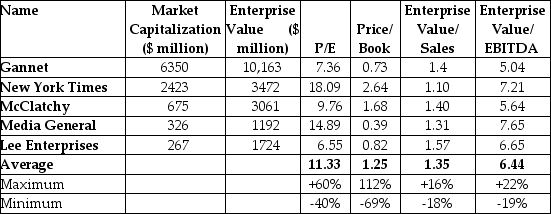

Use the table for the question(s) below.

-The table above shows the stock prices and multiples for a number of firms in the newspaper publishing industry. Another newspaper publishing firm (not shown) had sales of $620 million, EBITDA of $81 million, excess cash of $62 million, $11 million of debt, and 120 million shares outstanding. If the firm had an EPS of $0.41, what is the difference between the estimated share price of this firm if the average price-earnings ratio is used and the estimated share price if the average enterprise value/EBITDA ratio is used?

Definitions:

Variable Costing

An accounting method that includes only variable production costs (costs that vary with output) in product costs, while fixed costs are charged to the period they occur.

Operating Income

The financial gain obtained through the main functions of a firm, without considering the reductions for interest and taxes.

Absorption Costing

An approach in accounting that adds up all costs associated with manufacturing, including direct materials, workforce expenses, and all overhead costs, both variable and fixed, into the product pricing.

Variable Costing

An accounting method that only includes variable production costs (direct materials, direct labor, and variable manufacturing overhead) in product costs.

Q6: What is the decision criterion while using

Q10: Consider the following two projects: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg"

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" Visby Rides, a

Q25: A company issues a ten-year $1,000 face

Q41: Consider an economy with two types of

Q59: What is the coupon payment of a

Q74: What type of adjustment to debt is

Q83: The amount of a stock's risk that

Q107: A levered firm is one that has

Q114: Assuming that your capital is constrained, so