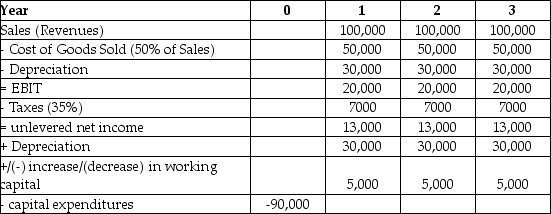

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:  The free cash flow for the first year of Epiphany's project is closest to ________.

The free cash flow for the first year of Epiphany's project is closest to ________.

Definitions:

Variable Costs

Costs that vary directly with the level of production or business activity, such as materials and labor.

Contribution Margin Ratio

The proportion of sales revenue that exceeds variable costs, representing the amount contributing to covering fixed costs and generating profit.

Operating Income

Earnings generated from a company's core business operations, excluding expenses and revenues that are not related to the primary activities.

Variable Costs

Variable costs are expenses that change in proportion to the activity of a business, such as sales volume or production levels.

Q3: In the method of comparables, the known

Q7: Which of the following risk-free, zero-coupon bonds

Q12: Which of the following statements is FALSE?<br>A)

Q15: A risk-free, zero-coupon bond with a face

Q36: A firm's cost of debt is the

Q38: How do the transaction costs of IPO

Q51: Temporary Housing Services Incorporated (THSI) is considering

Q72: What role does the correlation of two

Q75: A homeowner has a $227,000 home with

Q118: Assume that your capital is constrained, so