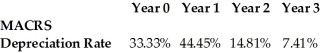

A fast-food company invests $2.2 million to buy machines for making slurpees. These can be depreciated using the MACRS schedule shown above. If the cost of capital is 10%, what is the increase in the net present value (NPV) of the product gained by using MACRS depreciation over straight-line depreciation for three years?

A fast-food company invests $2.2 million to buy machines for making slurpees. These can be depreciated using the MACRS schedule shown above. If the cost of capital is 10%, what is the increase in the net present value (NPV) of the product gained by using MACRS depreciation over straight-line depreciation for three years?

Definitions:

Plantar Flexes

The movement decreasing the angle between the dorsum of the foot and the leg, for example, standing on tiptoes.

Fibularis Brevis

A muscle of the lower leg that assists in plantar flexing and everting the foot.

Calf Bulge

The appearance of an enlarged or prominent portion of the calf muscle on the back of the lower leg.

Gastrocnemius

A major muscle in the calf of the leg, involved in walking, running, and jumping.

Q7: Jim owns a farm that he wants

Q8: The Sisyphean Company has a bond outstanding

Q18: Kirkevue Industries pays out all its earnings

Q42: Which of the following would be LEAST

Q54: Your estimate of the market risk premium

Q74: Your estimate of the market risk premium

Q75: Which of the following adjustments should NOT

Q78: Suppose that a stock gave a realized

Q89: Assume the total market value of General

Q104: Which of the following statements is FALSE?<br>A)