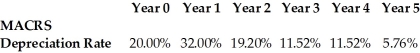

A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

Definitions:

Multiple-Product Order

An order placed by a customer that involves more than one type of product, often requiring additional logistical or managerial consideration.

National Highway Traffic Safety Administration

A U.S. government agency responsible for enforcing vehicle performance standards and reducing deaths, injuries, and economic losses resulting from motor vehicle crashes.

Motor Vehicles

Vehicles that are self-propelled and used for transportation on roads.

Telephone Solicitations

The practice of contacting individuals via telephone to offer goods, services, or solicit donations.

Q11: How are investors in zero-coupon bonds compensated

Q26: A university issues a bond with a

Q33: A 10% APR with quarterly compounding is

Q36: Which of the following is NOT a

Q40: Which of the following is NOT a

Q44: A firm has $2 million market value

Q46: Assume Ford Motor Company is discussing new

Q70: Epiphany Industries is considering a new capital

Q73: Stock issued in an IPO usually trades

Q104: What is the Net Present Value rule?