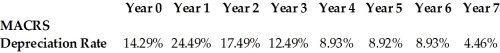

Massive Amusements, an owner of theme parks, invests $65 million to build a roller coaster. This can be depreciated using the MACRS schedule shown above. How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year, straight-line depreciation, if the tax rate is 35%?

Massive Amusements, an owner of theme parks, invests $65 million to build a roller coaster. This can be depreciated using the MACRS schedule shown above. How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year, straight-line depreciation, if the tax rate is 35%?

Definitions:

Social Media Posts

Content created and shared on social media platforms, including text, images, and videos, intended for public or private audiences.

Diversity Enrichment

Initiatives and practices aimed at promoting and embracing a wide range of cultural, ethnic, and gender differences within an organization or community.

Educational Goals

Specific objectives related to learning and academic achievement that an individual sets for themselves.

Nationalized

Refers to industries or sectors that have been transferred from private to government ownership and control.

Q5: If you want to value a firm

Q11: How are investors in zero-coupon bonds compensated

Q23: Assume Ford Motor Company is discussing new

Q25: A capital budget lists the potential projects

Q34: How much are each of the semiannual

Q51: Consider a project with the following cash

Q62: Jenkins Security has learned that a rival

Q67: Assume Lavender Corporation has a market value

Q90: Ford Motor Company is considering launching a

Q94: An investor holds a Ford bond with