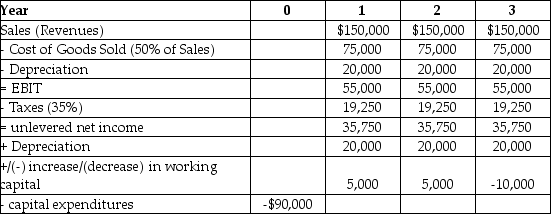

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:  The free cash flow for the last year of Epiphany's project is closest to ________.

The free cash flow for the last year of Epiphany's project is closest to ________.

Definitions:

LIFO

LIFO, or Last In, First Out, is an inventory valuation method where the last items to be added to inventory are assumed to be the first ones sold.

Ending Inventory

The total value of a company's merchandise, goods, and products held at the end of an accounting period.

Sales Revenue

The income received by a company from its sales of goods or the provision of services.

Gross Profit

The difference between revenue and the cost of making a product or providing a service, before deducting overheads, payroll, taxation, and interest payments.

Q1: Which of the following statements is FALSE?<br>A)

Q2: A convenience store owner is contemplating putting

Q3: If available, should MACRS be preferred to

Q6: The cost of issuing an IPO in

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" +---------+---------+---------+----- . .

Q41: According to Graham and Harvey's 2001 survey

Q48: Suppose you invest $1000 into a mutual

Q62: Consider the following realized annual returns: <img

Q71: You expect General Motors (GM) to have

Q93: Inflation is calculated as the rate of