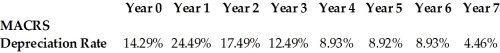

Massive Amusements, an owner of theme parks, invests $65 million to build a roller coaster. This can be depreciated using the MACRS schedule shown above. How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year, straight-line depreciation, if the tax rate is 35%?

Massive Amusements, an owner of theme parks, invests $65 million to build a roller coaster. This can be depreciated using the MACRS schedule shown above. How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year, straight-line depreciation, if the tax rate is 35%?

Definitions:

Consumer Debt

Consumer debt is a type of financial obligation that arises from the purchase of goods that are used for personal, family, or household purposes.

Credit Card Companies

Businesses that issue credit cards to consumers, facilitating electronic payment transactions and extending credit.

Bankruptcy

A judicial process relating to an individual or company that cannot settle their due obligations.

Chapter 11 Reorganization

Chapter 11 Reorganization refers to a provision under the U.S. bankruptcy code that allows a business to restructure its debt and operations in order to return to profitability under court supervision while continuing to operate.

Q7: Praetorian Industries will pay a dividend of

Q11: Many former employees at AlphaEnergy, an energy

Q25: Individual investors trade conservatively, given the difficulty

Q31: Use the table for the question(s) below.

Q33: Many financial managers use market risk premiums

Q46: Spacefood Products will pay a dividend of

Q53: The internal rate of return (IRR) is

Q82: There is a clear link between the

Q109: Greg purchased stock in Bear Stearns and

Q118: Assume that your capital is constrained, so