MACRS

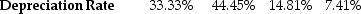

MACRS A firm is considering the purchase of a new machine for $325,000. The firm is unsure if it should use the 3-Year MACRS schedule or straight-line depreciation over three years. What is the difference in the book value after three years if the firm uses MACRS instead of straight-line depreciation?

A firm is considering the purchase of a new machine for $325,000. The firm is unsure if it should use the 3-Year MACRS schedule or straight-line depreciation over three years. What is the difference in the book value after three years if the firm uses MACRS instead of straight-line depreciation?

Definitions:

Government Employment

Jobs or positions held within governmental organizations, including local, state, or federal levels.

Income Transfers

Financial distributions without a direct exchange of goods or services, aimed at reducing inequality and supporting individuals in need.

American Families

Social units typically consisting of one or more parents and their children, recognized in the United States, with varying structures and dynamics.

GDP

Gross Domestic Product, a measure of the economic performance of a country, representing the total value of all goods and services produced over a specific time period.

Q14: Your firm needs to invest in a

Q20: Aaron Inc. has 321 million shares outstanding.

Q39: As part of the registration statement, the

Q44: A janitorial services firm is considering two

Q45: A firm incurs $35,000 in interest expenses

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" The above table

Q54: Your estimate of the market risk premium

Q67: Which of the following best describes the

Q79: You are considering purchasing a new automobile

Q91: A firm raised all its capital via