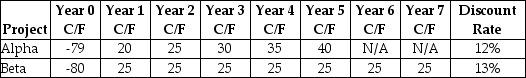

Consider the following two projects:  The net present value (NPV) for project alpha is closest to ________.

The net present value (NPV) for project alpha is closest to ________.

Definitions:

Refuses to Bargain

Occurs when an employer or union does not engage in good faith negotiation over wages, hours, and other terms of employment.

Hiring Hall

A place operated by a labor union or an employer association where workers are matched with available jobs, typically in the maritime and construction industries.

Duty of Fair Representation

The obligation of a union to represent all members fairly, impartially, and in good faith, particularly during collective bargaining and grievance processes.

Visible Minority Females

Women who belong to racial or ethnic minority groups that are distinguishable by physical characteristics or color, and may face unique social and economic challenges.

Q8: A portfolio has 30% of its value

Q10: Which of the following statements regarding bonds

Q14: The profitability index can break down completely

Q16: If a few intermediate cash flows in

Q42: A stock market comprises 4600 shares of

Q51: Historically, why were high inflation rates associated

Q57: Assume JUP has debt with a book

Q63: A portfolio comprises two stocks, A and

Q86: What is one of the main obstacles

Q106: You are in the process of purchasing