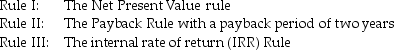

Mary is in contract negotiations with a publishing house for her new novel. She has two options. She may be paid $100,000 up front, and receive royalties that are expected to total $26,000 at the end of each of the next five years. Alternatively, she can receive $200,000 up front and no royalties. Which of the following investment rules would indicate that she should take the former deal, given a discount rate of 8%?

Definitions:

Revocable Offer

An offer that can be withdrawn by the offering party before it is accepted by the offeree, typically within a certain time frame.

Unilateral Offer

An offer made by one party where acceptance is performed through an action rather than a promise of action.

Construct

A construct is an abstract idea or concept constructed by combining different elements of knowledge, often used in various fields such as psychology and sociology.

Misprint

A mistake in printed material resulting from mechanical failures of some kind.

Q3: Assume that you are 30 years old

Q5: The outstanding debt of Berstin Corp. has

Q9: Sinclair Pharmaceuticals, a small drug company, develops

Q10: A portfolio has 45% of its value

Q39: Which of the following situations would result

Q39: Which of the following best illustrates why

Q81: Martin is offered an investment where for

Q93: Inflation is calculated as the rate of

Q98: Big Cure and Little Cure are both

Q102: The price of Microsoft is $30 per