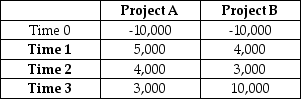

If WiseGuy Inc. is choosing one of the above mutually exclusive projects (Project A or Project B) , given a discount rate of 7%, which should the company choose?

If WiseGuy Inc. is choosing one of the above mutually exclusive projects (Project A or Project B) , given a discount rate of 7%, which should the company choose?

Definitions:

Accounting

The systematic process of recording, measuring, and communicating financial information about economic entities.

Q17: A manufacturer of breakfast cereals has the

Q20: Why is the personal decision a financial

Q27: A ten-year, zero-coupon bond with a yield

Q32: A linear regression was done to estimate

Q36: Suppose that when these bonds were issued,

Q60: Market forces determine interest rates based ultimately

Q68: Companies that sell household products and food

Q68: Cameron Industries is purchasing a new chemical

Q71: On Commodity Exchange A, it is possible

Q80: You are scheduled to receive $10,000 in