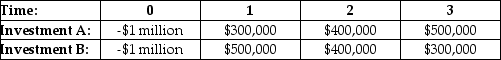

An investor is considering the two investments shown above. Her cost of capital is 8%. Which of the following statements about these investments is true?

An investor is considering the two investments shown above. Her cost of capital is 8%. Which of the following statements about these investments is true?

Definitions:

Duration

An indicator that represents how the price of a bond or any similar type of debt is affected by interest rate fluctuations, displayed as a duration in years.

Mispricing

Situations where the market price of an asset deviates from its theoretical or intrinsic value.

Coupon Payments

Regular interest payments made to bondholders, typically on a semi-annual basis, based on the bond's interest rate.

Maturity Value

The amount of money an investment will produce at the end of its holding period, including the principal and interest or dividends.

Q2: If the rate of interest (r) is

Q4: Which of the following investments had the

Q16: Which of the following best explains why

Q19: You expect KT Industries (KTI) will have

Q21: If you want to value a firm

Q22: A delivery service is buying 600 tires

Q25: A security firm is offered $80,000 in

Q73: A mining company plans to mine a

Q79: You are considering purchasing a new automobile

Q100: Cameron Industries is purchasing a new chemical