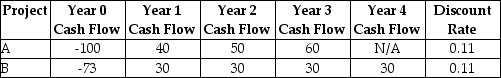

Consider the following two projects:  Assume that projects A and B are mutually exclusive. The correct investment decision and the best rationale for that decision is to ________.

Assume that projects A and B are mutually exclusive. The correct investment decision and the best rationale for that decision is to ________.

Definitions:

L Data

Life record data in personality psychology, referring to objective data collected from a person's life such as school grades or employment history.

B Data

Observational data about a person's behavior that is collected directly from the environment, as opposed to self-reported measures or tests.

I Data

I Data, in the context of psychological research, typically refers to informant data, which is information reported by someone familiar with the individual being assessed, used to gain insights into the individual's behavior or traits.

Thematic Apperception Test

A projective psychological test in which respondents reveal their underlying motives, feelings, and personality traits through the stories they make up about ambiguous pictures.

Q6: What is the decision criterion while using

Q18: Rational investors _ fluctuations in the value

Q21: If you want to value a firm

Q26: A university issues a bond with a

Q32: Which of the following bonds will be

Q35: Which of the following will NOT increase

Q36: Historically, the average excess return of the

Q44: In an effort to maintain price stability,

Q85: The real interest rate is the rate

Q95: A bakery is deciding whether to buy