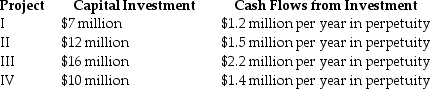

A company has four projects it wishes to undertake. Which of these investments should be the lowest priority, given a discount rate of 5%?

A company has four projects it wishes to undertake. Which of these investments should be the lowest priority, given a discount rate of 5%?

Definitions:

Derived Tax Revenue

Income obtained by government authorities through taxation that is influenced or generated from specific business activities or transactions.

FICA

The Federal Insurance Contributions Act, a U.S. law requiring a deduction from paychecks to fund Social Security and Medicare.

Property Taxes

Taxes imposed on property owners by local governments, based on the assessed value of their property, including lands and buildings.

Governmental Funds

Categories of funds used by governments in accounting to segregate transactions related to specific government functions, such as education or public safety.

Q2: Stocks have both diversifiable risk and undiversifiable

Q5: What is the future value (FV) of

Q13: A company that manufactures copper piping is

Q14: What diversification, if any, is achieved if

Q24: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" The table above

Q47: Prior to its maturity date, the price

Q56: The beta of the market portfolio is

Q58: A consultancy calculates that it can supply

Q68: An investor is considering a project that

Q86: What is the assumption about risk when