Use the information for the question(s) below.

-The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 5 years. The bond certificate indicates that the stated coupon rate for this bond is 8.1% and that the coupon payments are to be made semiannually. Assuming the appropriate YTM on the Sisyphean bond is 10.6%, then this bond will trade at ________.

Definitions:

Moving From Point

The process of going from one position or condition to another, often used in discussions about changes in economic indicators or market positions.

Perfectly Adaptable

Characterizes a scenario or system that is fully capable of adjusting seamlessly to changes or different conditions.

Opportunity Cost

Forgoing potential gains from different options when a specific alternative is selected.

Law Of Increasing

This term seems incomplete. If referring to the "Law of Increasing Costs," it describes how producing more of one good requires increasingly larger sacrifices of other goods.

Q18: Kirkevue Industries pays out all its earnings

Q22: A delivery service is buying 600 tires

Q36: You can evaluate alternative projects with different

Q38: What is the coupon payment of a

Q46: Quality adjustments to changes in the CPI

Q48: Consider the following price and dividend data

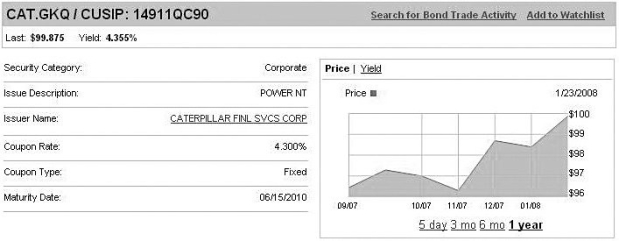

Q78: Shown above is information from FINRA regarding

Q82: You are considering investing in a zero-coupon

Q90: Consider a project with the following cash

Q104: Michael has a credit card debt of