Use the information for the question(s) below.

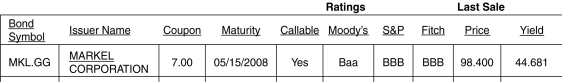

-Which of the following best describes a bond rated by Standard & Poor's and Moody as B?

Definitions:

Tax-sheltered Retirement Plans

Retirement savings plans that provide tax advantages to the saver, often by allowing pre-tax contributions or tax-free growth.

Tax Bill

The total amount of tax owed by an individual or corporation to a taxing authority, after all deductions, credits, and exemptions.

Take-home Pay

The amount of income left after deductions such as taxes and social security contributions have been subtracted from an individual's gross salary.

Taxes Combined

A calculation that aggregates all applicable taxes (federal, state, local) on an individual or entity's income.

Q26: An investor buys a property for $608,000

Q30: A perpetuity has a PV of $20,000.

Q31: Valorous Corporation will pay a dividend of

Q34: An investor estimates the value of a

Q35: When computing a present value, which of

Q53: Valence Electronics has 213 million shares outstanding.

Q64: A corporate bond makes payments of $9.67

Q85: Which of the following best describes why

Q106: You are in the process of purchasing

Q109: Which of the following statements regarding bonds