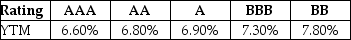

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing ten-year bonds with a face value of $1,000 and a coupon rate of 7.5% (annual payments) . The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:  Assuming that Luther's bonds are rated AAA, their price will be closest to ________.

Assuming that Luther's bonds are rated AAA, their price will be closest to ________.

Definitions:

Material Facts

Important information that could influence a decision-making process, particularly in legal and financial contexts.

Justifiably Relied

A legal principle where a party has a right to depend on the information or commitment of another, expecting it to be true or honored.

Fraudulent Misrepresentation

A false statement intentionally made to deceive, causing the victim to rely upon it to their detriment.

Suspension

The temporary cessation or pause of an activity, status, or function, often as a disciplinary measure or pending an investigation.

Q11: In an efficient market, investors will only

Q35: The discounted free cash flow model ignores

Q38: Your firm needs to invest in a

Q56: Which of the following statements is FALSE?<br>A)

Q66: The balance sheet shows the assets, liabilities,

Q77: What must be the price of a

Q81: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" Refer to the

Q91: A home buyer buys a house for

Q97: A Xerox DocuColor photocopier costing $44,000 is

Q100: You are offered an investment opportunity that