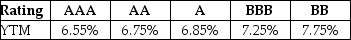

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing ten-year bonds with a face value of $1,000 and a coupon rate of 7.3% (annual payments) . The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:  Assuming that Luther's bonds receive a AAA rating, the number of bonds that Luther must issue to raise the needed $25 million is closest to ________.

Assuming that Luther's bonds receive a AAA rating, the number of bonds that Luther must issue to raise the needed $25 million is closest to ________.

Definitions:

Scholars

Individuals who engage in advanced study and research in a particular field, often contributing knowledge and insights.

Practitioners

Professionals who actively engage in a particular occupation, profession, or field of study.

Nonprofit Sector Management

The administration and operational strategies of organizations within the nonprofit sector, emphasizing efficiency, mission fulfillment, and sustainability.

Nonprofit Management Programs

Educational or training initiatives designed to improve the skills and knowledge of those running nonprofit organizations.

Q22: WorldCom classified $3.85 billion in operating expenses

Q33: The notes to the financial statements would

Q38: Balance Sheet <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt="Balance Sheet

Q65: Which of the following is NOT a

Q81: What is the most important function of

Q85: The real interest rate is the rate

Q85: Which of the following best describes why

Q102: Shepard Industries is evaluating a proposal to

Q103: A 2013 Toyota Camry can be bought

Q109: Which of the following statements regarding bonds