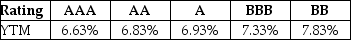

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing ten-year bonds with a face value of $1,000 and a coupon rate of 6.0% (annual payments) . The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:  Assuming that Luther's bonds receive a AA rating, the price of the bonds will be closest to ________.

Assuming that Luther's bonds receive a AA rating, the price of the bonds will be closest to ________.

Definitions:

Ethical Challenge

Situations where one must make a decision that involves conflicting moral principles or values.

Loyalty

The quality of being faithful in commitment to one's obligations, an organization, or individuals, often resulting in mutual respect and trust.

Conceal Information

The act of deliberately hiding or withholding information from those who have the right or need to know it.

Corporate Culture

The shared values, beliefs, behaviors, and practices that characterize a company or organization.

Q4: What role do dividends play in stock

Q20: A company buys tracking software for its

Q38: Individual investors who grow up and live

Q45: The term "opportunity" in opportunity cost of

Q53: In 2007, interest rates were about 4.5%

Q58: What is the present value (PV) of

Q68: An investor is considering a project that

Q82: You are considering investing in a zero-coupon

Q95: Bond traders generally quote bond yields rather

Q99: Using the following financial data, determine the