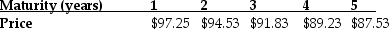

The above table shows the price per $100-face value bond of several risk-free, zero-coupon bonds. What is the yield to maturity of the two year, zero-coupon, risk-free bond shown?

The above table shows the price per $100-face value bond of several risk-free, zero-coupon bonds. What is the yield to maturity of the two year, zero-coupon, risk-free bond shown?

Definitions:

Expected Returns

The anticipated return on an investment, representing the mean of the probability distribution of the possible returns.

Reward to Risk Ratio

A metric used to compare the expected returns of an investment to the amount of risk undertaken to capture these returns.

Total Risk

The overall risk associated with an investment, including both systematic and unsystematic risks.

Market Risk

The potential for a loss faced by an investor, which is attributed to elements that influence the total performance of the financial markets.

Q3: A company intends to install new management

Q11: In an efficient market, investors will only

Q15: What is the general shape of the

Q16: Consider the following average annual returns: <img

Q41: Which of the following statements regarding bonds

Q72: Which of the following computes the growth

Q83: Which of the following bonds is trading

Q84: What care, if any, should be taken

Q89: Two years ago you purchased a new

Q97: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" Panjandrum Industries, a