Use the information for the question(s) below.

-The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 10 years. The bond certificate indicates that the stated coupon rate for this bond is 8.2% and that the coupon payments are to be made semiannually. Assuming the appropriate YTM on the Sisyphean bond is 7.3%, then the price that this bond trades for will be closest to ________.

Definitions:

Security Interest

A legal right or claim on assets granted to a creditor to secure the repayment of a debt or obligation.

Perfection

The process of securing a security interest against third parties, especially in relation to secured transactions.

Secured Party

A lender or seller who holds a security interest.

Mortgagor

The borrower in a mortgage agreement who pledges property to the lender as security for the loan.

Q6: Firms should use the most accelerated depreciation

Q8: Which of the following is NOT a

Q9: Why is it usually necessary to use

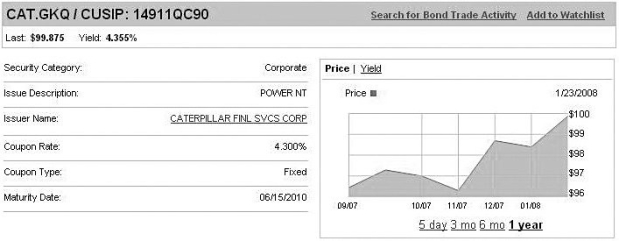

Q9: Consider the following yields to maturity on

Q12: The current zero-coupon yield curve for risk-free

Q26: A software company acquires a smaller company

Q31: A company buys a color printer that

Q69: The effective annual rate (EAR) for a

Q82: There is a clear link between the

Q108: McCoy paid a one-time special dividend of