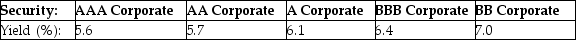

A mining company needs to raise $100 million in order to begin open-pit mining of a coal seam. The company will fund this by issuing 30-year bonds with a face value of $1,000 and a coupon rate of 6.5%, paid annually. The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings. If the company's bonds are rated A, what will be their selling price?

A mining company needs to raise $100 million in order to begin open-pit mining of a coal seam. The company will fund this by issuing 30-year bonds with a face value of $1,000 and a coupon rate of 6.5%, paid annually. The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings. If the company's bonds are rated A, what will be their selling price?

Definitions:

Compounded Semiannually

A different phrase for interest calculation done two times a year, where interest is added to the principal for future interest calculation.

Compounded Monthly

A method of calculating interest where the accumulated interest is added back to the principal sum each month.

Residential Mortgage Loan

A loan secured by real property through the use of a mortgage note, typically used to purchase residential properties.

Mortgage Broker

A professional intermediary who helps borrowers find the best mortgage deals by comparing offers from different lenders.

Q15: Which of the following statements is FALSE?<br>A)

Q39: Cash is a _.<br>A) long-term asset<br>B) current

Q47: Sunnyfax Publishing pays out all its earnings

Q65: Before it matures, the price of any

Q67: Balance Sheet <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt="Balance Sheet

Q69: A bond will trade at a discount

Q90: The State Bank offers an interest rate

Q92: The current zero-coupon yield curve for risk-free

Q104: Michael has a credit card debt of

Q106: A consumer good company is developing a