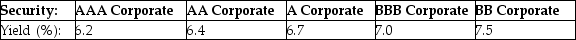

Consolidated Insurance wants to raise $35 million in order to build a new headquarters. The company will fund this by issuing 10-year bonds with a face value of $1,000 and a coupon rate of 6.3%, paid semiannually. The above table shows the yield to maturity for similar 10-year corporate bonds of different ratings. Which of the following is closest to how many more bonds Consolidated Insurance would have to sell to raise this money if their bonds received an A rating rather than an AA rating?

Consolidated Insurance wants to raise $35 million in order to build a new headquarters. The company will fund this by issuing 10-year bonds with a face value of $1,000 and a coupon rate of 6.3%, paid semiannually. The above table shows the yield to maturity for similar 10-year corporate bonds of different ratings. Which of the following is closest to how many more bonds Consolidated Insurance would have to sell to raise this money if their bonds received an A rating rather than an AA rating?

Definitions:

Oil Exports

The sale and shipment of crude oil or refined petroleum products from one country to another.

Production Increase

refers to a rise in the quantity of goods or services produced over a specific period.

Interdependent

The mutual reliance between two or more entities, where changes in one affect the others.

Perfect Competitors

Refers to businesses in a market structure where they sell homogenous products, face no barriers to entry or exit, and none of them can influence the market price.

Q4: Which of the following is the main

Q11: Assuming everything else remains unchanged, how does

Q15: The principal goal of a financial manager

Q18: If you value a stock using a

Q36: Suppose the term structure of interest rates

Q64: The owner of a hair salon spends

Q65: The table above shows the rate of

Q67: Assume your current mortgage payment is $900

Q72: Under what situation can the net present

Q77: Suppose the term structure of interest rates