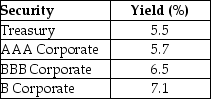

Consider the following yields to maturity on various one-year, zero-coupon securities:  The price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a BBB rating is closest to ________.

The price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a BBB rating is closest to ________.

Definitions:

Age Discrimination

Unfair treatment of an individual or group based on their age, particularly in employment settings.

ADEA

Age Discrimination in Employment Act, a U.S. law designed to protect workers and job applicants aged 40 and over from age-based discrimination.

Bona Fide Occupational Qualification

An employment qualification that an employer can legally consider while making decisions about hiring and retaining employees, provided it is reasonably necessary to the normal operation of the particular business.

Hostile-Environment Sexual Harassment

Unwelcome sexual conduct that creates an intimidating, hostile, or offensive working environment.

Q10: Accounts payable is a _.<br>A) long-term liability<br>B)

Q26: What do you understand by break-even analysis?

Q27: If your new strip mall will have

Q38: What is the decision criterion using the

Q57: Which of the following statements regarding arbitrage

Q61: Which of the following statements regarding the

Q66: Which of the following is NOT a

Q67: Assume your current mortgage payment is $900

Q81: Consider a zero-coupon bond with a $1000

Q89: Which of the following bonds will be