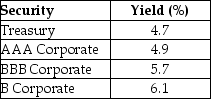

Consider the following yields to maturity on various one-year, zero-coupon securities:  The credit spread of the B corporate bond is closest to ________.

The credit spread of the B corporate bond is closest to ________.

Definitions:

Aquatic Mammals

Mammals that are primarily adapted to living in water, including species such as whales, dolphins, and seals.

Slow Fibers

Muscle fibers characterized by their slow contraction time and enhanced ability to sustain long-term activities.

Fast (IIb) Fibers

Muscle fibers that contract quickly and powerfully but fatigue rapidly, predominantly used for explosive movements.

Skeletal Muscle

A type of striated muscle tissue which is under voluntary control, responsible for movement of the skeleton and various body parts.

Q1: A growing perpetuity, where the rate of

Q2: Why must care be taken when comparing

Q13: What is the dirty price of a

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" +---------+---------+---------+----- . .

Q19: What is one of the prerequisite conditions

Q36: A perpetuity will pay $1000 per year,

Q71: Assume that your capital is constrained, so

Q80: Helen owns 10.2% of the stock of

Q97: A Xerox DocuColor photocopier costing $44,000 is

Q119: Tanner is choosing between two investment options.