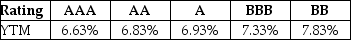

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing ten-year bonds with a face value of $1,000 and a coupon rate of 6.0% (annual payments) . The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:  Assuming that Luther's bonds receive a AA rating, the price of the bonds will be closest to ________.

Assuming that Luther's bonds receive a AA rating, the price of the bonds will be closest to ________.

Definitions:

Q4: Joe borrows $100,000 and agrees to repay

Q4: Which of the following is the main

Q21: The only cash payment an investor in

Q29: An investor is considering the two investments

Q35: What are the most difficult parts of

Q40: To evaluate a capital budgeting decision, it

Q47: A bank offers an account with an

Q49: Suppose that a young couple has just

Q71: Assume that your capital is constrained, so

Q77: Consider the following list of projects:<br> <img