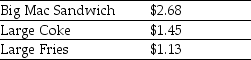

Consider the following prices from a McDonald's Restaurant:  A McDonald's Big Mac value meal consists of a Big Mac sandwich, large Coke, and a large fries. Assume that there is a competitive market for McDonald's food items and that McDonald's sells the Big Mac value meal for $4.59. Does an arbitrage opportunity exists and if so how would you exploit it and how much would you make on one value meal?

A McDonald's Big Mac value meal consists of a Big Mac sandwich, large Coke, and a large fries. Assume that there is a competitive market for McDonald's food items and that McDonald's sells the Big Mac value meal for $4.59. Does an arbitrage opportunity exists and if so how would you exploit it and how much would you make on one value meal?

Definitions:

SML Approach

Refers to the Security Market Line approach, a graphical representation in the Capital Asset Pricing Model (CAPM) that depicts the relationship between risk and expected return for all securities.

Flotation Costs

Expenses incurred by a company in issuing new securities, including legal, administrative, and underwriting fees.

Computed NPV

The calculated Net Present Value based on a specific discount rate and series of cash flows.

Perpetual Cash Flows

Cash flows that are expected to continue indefinitely without an end.

Q9: Sinclair Pharmaceuticals, a small drug company, develops

Q25: A company issues a ten-year $1,000 face

Q38: Which of the following would be more

Q43: Which of the following bonds is trading

Q58: What is the present value (PV) of

Q70: Price/earnings ratios are _ for firms with

Q72: A firm whose primary business is in

Q88: What is the implied assumption about interest

Q95: An investor earned a holding period return

Q105: Ski Lifts Inc.is a highly seasonal business.The