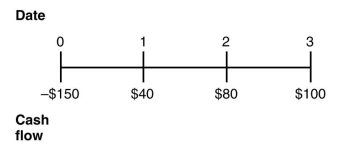

Consider the following timeline:  If the current market rate of interest is 13%, then the value of the cash flows in year 0 and year 2 as of year 1 is closest to ________.

If the current market rate of interest is 13%, then the value of the cash flows in year 0 and year 2 as of year 1 is closest to ________.

Definitions:

Process Capability Index

A statistical measure that quantifies how well a process is able to produce output within specification limits compared to the spread of the process values.

Acceptance Plan

An Acceptance Plan outlines the criteria and process by which project deliverables are verified and accepted by stakeholders.

Good And Bad Lots

Terms used in quality control to distinguish between batches of products where good lots meet quality standards and bad lots fail to meet those standards.

Range Charts

A type of control chart used in statistical process control to monitor the dispersion or variability of a process.

Q13: Which of the following best describes the

Q15: Elinore is asked to invest $5100 in

Q24: Credenza Industries is expected to pay a

Q36: You expect KT industries (KTI) will have

Q38: Refer to Foxy Ladies Investment Club.What was

Q42: What must be the price of a

Q52: NoGrowth Industries presently pays an annual dividend

Q69: Consider the following two projects: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg"

Q72: An investor purchased a share of AutheTec

Q99: Refer to Foxy Ladies Investment Club.What was