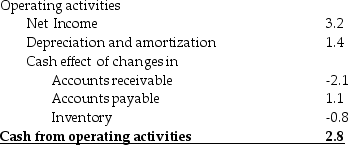

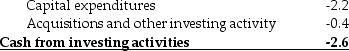

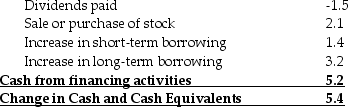

AOS Industries Statement of Cash Flows for 2008  Investment activities

Investment activities Financing activities

Financing activities Consider the above statement of cash flows. In 2008, AOS Industries had contemplated buying a new warehouse for $3 million, the cost of which would be depreciated over 10 years. If AOS Industries has a tax rate of 25%, what would be the impact for the amount of cash held by AOS at the end of the 2008?

Consider the above statement of cash flows. In 2008, AOS Industries had contemplated buying a new warehouse for $3 million, the cost of which would be depreciated over 10 years. If AOS Industries has a tax rate of 25%, what would be the impact for the amount of cash held by AOS at the end of the 2008?

Definitions:

Capital Stock

The total amount of shares that a corporation is authorized to issue, as represented in its financial statements.

Commission Charges

Fees paid for services, usually a percentage of the transaction made or handled by a service provider.

Dollar Amount

The numeric monetary value or cost expressed in terms of dollars.

Capital Stock

The total amount of a company's shares of stock that have been authorized, issued, and purchased by investors, representing ownership in the company.

Q3: When there are large numbers of people

Q20: Why is the personal decision a financial

Q23: A limit order, which is an order

Q44: The exchanges in which of the following

Q46: The consensus advice from successful professional investors

Q52: NoGrowth Industries presently pays an annual dividend

Q59: All of the following variables must be

Q60: Which of the following formulas is INCORRECT?<br>A)

Q67: Beefcake Burgers' stock has a current market

Q136: Determining the appropriate amount of total current