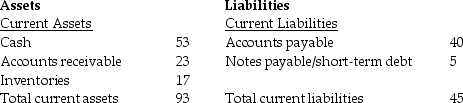

Balance Sheet

Net property, plant,

Net property, plant, The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 5 million shares outstanding, and these shares are trading at a price of $6.39 per share, what does this tell you about how investors view this firm's book value?

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 5 million shares outstanding, and these shares are trading at a price of $6.39 per share, what does this tell you about how investors view this firm's book value?

Definitions:

Roses

Flowering plants known for their beauty and fragrance, often cultivated for decorative purposes and their symbolic significance in various cultures.

Consumer Surplus

A term often used to refer both to individual consumer surplus and to total consumer surplus.

International Trade

International trade involves the exchange of goods and services between countries, driven by comparative advantages that allow countries to produce goods more efficiently.

Autarky Price

The price of a good in a closed economy that does not engage in international trade, determined solely by domestic supply and demand.

Q5: What is the future value (FV) of

Q17: Individuals who try to make a quick

Q19: The Dow Theory states that as long

Q20: An order that specifies the price at

Q32: Howard is saving for a holiday. He

Q65: Before it matures, the price of any

Q65: Price-earnings ratios tend to be high for

Q77: Consider the following list of projects:<br> <img

Q100: In 2009, U.S. Treasury yielded 0.1%, while

Q159: Your company has been offered credit terms