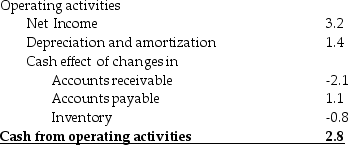

AOS Industries Statement of Cash Flows for 2008  Investment activities

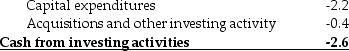

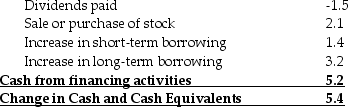

Investment activities Financing activities

Financing activities Consider the above statement of cash flows. In 2008, AOS Industries had contemplated buying a new warehouse for $3 million, the cost of which would be depreciated over 10 years. If AOS Industries has a tax rate of 25%, what would be the impact for the amount of cash held by AOS at the end of the 2008?

Consider the above statement of cash flows. In 2008, AOS Industries had contemplated buying a new warehouse for $3 million, the cost of which would be depreciated over 10 years. If AOS Industries has a tax rate of 25%, what would be the impact for the amount of cash held by AOS at the end of the 2008?

Definitions:

Extremely Obese

A classification of obesity where an individual has a body mass index (BMI) significantly higher than the obesity threshold, indicating severe excess weight.

Bariatric Bed

A specially designed bed to accommodate overweight or obese patients, providing extra support, width, and durability.

Air-fluidized Bed

An air-fluidized bed is a therapeutic bed that uses a technology similar to fluidization, promoting healing of certain types of wounds by reducing pressure on the body.

Pressure Ulcer Risk Scale

A tool used in healthcare to assess a patient's risk of developing pressure ulcers, based on factors like mobility, skin condition, and nutritional status.

Q1: Since its inception five years ago, Companioni

Q10: What are the main differences between a

Q29: Use the information below to solve for

Q31: A middleman, or agent, who helps investors

Q38: Your firm needs to invest in a

Q44: Refer to Foxy Ladies Investment Club.What was

Q45: The term "opportunity" in opportunity cost of

Q54: Refer to the balance sheet above. If

Q86: Consider the above Income Statement for Xenon

Q108: Which of the following is/are TRUE? I.