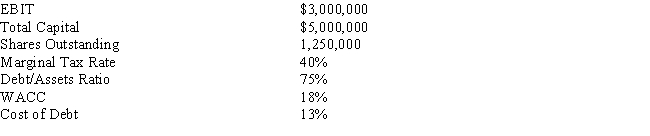

Using the following financial data, determine the maximum dividends per share that can be paid to stockholders before the firm's value would be threatened.Base your answer on the economic value added model.

Definitions:

Future Value

The value of an asset or amount of money at a specific date in the future, adjusted for factors like interest or inflation.

Market Rate

The interest rate available to most borrowers in the financial market, applied to loans or savings products.

Expected Profit

The forecasted or anticipated earnings from an investment or business activity, considering potential risks and returns.

Current Cost

The price that would be paid for goods or services if purchased in the current market, as opposed to historical cost.

Q22: You are purchasing a new home and

Q37: You have a used CD store. At

Q46: All of the following are examples of

Q54: Whenever a good trades in a competitive

Q75: The income statement reports the firm's revenues

Q75: The weighted average cost of capital (WACC)

Q93: Which of the following firms would be

Q95: Corey buys 10 Tufflift 4-post, 4.5-ton car

Q97: Industries that are comprised of companies that

Q148: Small, undercapitalized firms<br>A) Are generally users of