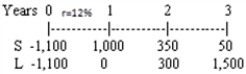

A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below:  The company's required rate of return is 12 percent, and it can get an unlimited amount of funds at that rate.What is the IRR of the better project, i.e., the project which the company should choose if it wants to maximize the price of its stock?

The company's required rate of return is 12 percent, and it can get an unlimited amount of funds at that rate.What is the IRR of the better project, i.e., the project which the company should choose if it wants to maximize the price of its stock?

Definitions:

Random Sample

A subset of individuals chosen from a larger population, where each individual has an equal chance of being selected, used to infer population characteristics.

Small Bag

A diminutive container used for carrying personal items or purchases, typically hand-held or shoulder-mounted.

Large-Sample Z

A statistical method used to approximate the significance of difference between means, applicable when sample size is large and variances are known or assumed to be equal.

Corresponding P-Value

The probability of obtaining a test statistic at least as extreme as the one that was actually observed, assuming that the null hypothesis is true.

Q19: Garcia Inc.has a current dividend of $3.00

Q27: An increase in a current asset account

Q29: A recession occurs when the economy contracts

Q54: Which of the following statements is most

Q61: If the calculated NPV is negative, then

Q74: Fundamental analysis attempts to determine the intrinsic

Q89: Capital budgeting decisions must be based on

Q92: Margin trading allows investors to magnify the

Q103: A firm cannot change its beta through

Q106: Business risk is concerned with the operations