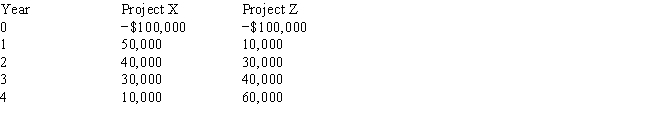

As the director of capital budgeting for Denver Corporation, you are evaluating two mutually exclusive projects with the following net cash flows:  If Denver's required rate of return is 15 percent, you would choose?

If Denver's required rate of return is 15 percent, you would choose?

Definitions:

Financing Activities

Transactions related to raising capital and repaying investors, including issuing equity, obtaining loans, and paying dividends.

Cash Flows

The total amount of money being transferred into and out of a business, affecting its liquidity.

Investing Activities

Transactions and events related to the acquisition and disposal of long-term assets and other investments not included in cash equivalents.

Cash Flows

The total amount of money being transferred into and out of a business, especially as affecting liquidity.

Q5: In capital budgeting analyses, it is possible

Q28: You are holding a stock which has

Q31: A middleman, or agent, who helps investors

Q42: Sound Systems Inc.wants to use the economic

Q45: Firms hold cash balances in order to

Q55: Which of the following constitutes an example

Q67: Refer to Byron Corporation.Assume that at one

Q75: For a firm that makes heavy use

Q78: The holding period return associated with an

Q110: Refer to Rollins Corporation.What is Rollins' cost