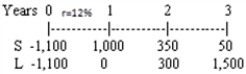

A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below:  The company's required rate of return is 12 percent, and it can get an unlimited amount of funds at that rate.What is the IRR of the better project, i.e., the project which the company should choose if it wants to maximize the price of its stock?

The company's required rate of return is 12 percent, and it can get an unlimited amount of funds at that rate.What is the IRR of the better project, i.e., the project which the company should choose if it wants to maximize the price of its stock?

Definitions:

GDDR6

An advanced version of graphics double data rate SDRAM, intended for use in graphics cards, game consoles, and high-performance computing.

GDDR5

A type of DRAM graphics memory that offers higher speeds and bandwidth for graphical processing units (GPUs) compared to its predecessors.

GDDR4

A type of graphics card memory technology designed for higher performance in 3D rendering and gaming applications.

GDDR3

A type of graphics double data rate synchronous dynamic random-access memory, used in graphics cards and gaming consoles for high-speed data transfer.

Q18: For markets to be in equilibrium, that

Q37: The last dividend on Spirex Corporation's common

Q75: The weighted average cost of capital (WACC)

Q77: Refer to J.Ross and Sons.What is the

Q81: Funds acquired by the firm through retaining

Q82: Company X has beta = 1.6, while

Q96: Net present value and internal rate of

Q114: The firm's cost of capital represents the

Q131: Which of the following is not discussed

Q145: A firm is considering the purchase of