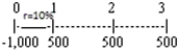

Your company is choosing between the following non-repeatable, equally risky, mutually exclusive projects with the cash flows shown below.Your required rate of return is 10 percent.How much value will your firm sacrifice if it selects the project with the higher IRR? Project S:  Project L:

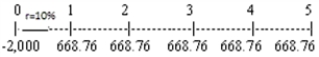

Project L:

Definitions:

Customs Tariff Act

Legislation that sets the tariffs and duties imposed on goods that are imported or exported.

Customs Act

Legislation that governs the importation and exportation of goods in and out of a country.

Wrong Rate

The incorrect or inappropriate pricing rate applied to a service, product, or financial transaction.

Licensing

The act of granting permission to use intellectual property rights, such as patents or trademarks, under agreed terms and conditions.

Q31: Your company paid a dividend of $2.00

Q37: The one-year holding period returns for Cherokee

Q40: The correct discount rate for a firm

Q63: You are the owner of 100 bonds

Q78: HR Corporation has a beta of 2.0,

Q87: Which of the following statements is correct?<br>A)

Q91: If the IRR of normal Project X

Q95: Mid-State Electric Company must clean up the

Q107: Which of the following statements is false?<br>A)

Q190: Stanton Inc.is considering the purchase of a