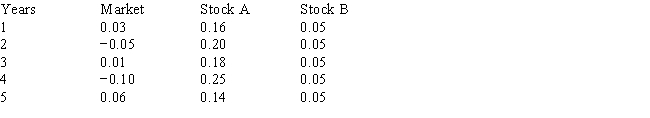

You have developed data which give (1) the average annual returns on the market for the past five years, and (2) similar information on Stocks A and B.If these data are as follows, which of the possible answers best describes the historical betas for A and B?

Definitions:

Demand Requirements

The specific needs or quantities of products or services required by the market or a particular customer.

Qualitative Forecasting

The method of prediction based on non-quantifiable information such as expert opinions, industry trends, and qualitative comparisons.

Scenario Planning

A method used by organizations to visualize and plan for possible future conditions or events and how to respond to them.

Nominal Group Techniques

A structured method for group brainstorming that encourages contributions from everyone in the group and is used to generate and prioritize ideas or solutions.

Q4: The term "spontaneously generated funds" generally refers

Q18: There exists an IRR solution for each

Q42: In signaling theory, when a manager has

Q58: Asymmetric information involves a situation where the

Q58: An all-equity firm is analyzing a potential

Q73: Which of the following statements is correct?<br>A)

Q90: If the expected rate of return on

Q109: The dividend irrelevance theory, proposed by Miller

Q110: Refer to Rollins Corporation.What is Rollins' cost

Q123: All else equal, a higher required rate