True/False

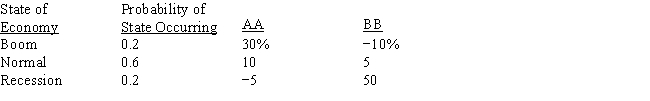

The distributions of rates of return for Companies AA and BB are given below:  We can conclude from the above information that any rational risk-averse investor will add Security AA to a well-diversified portfolio over Security BB.

We can conclude from the above information that any rational risk-averse investor will add Security AA to a well-diversified portfolio over Security BB.

Definitions:

Related Questions

Q25: All else equal, a higher required rate

Q38: According to MM, in a world without

Q47: Your father, who is 60, plans to

Q48: Once the target capital structure for a

Q72: Jill's Wigs Inc.had the following balance sheet

Q85: Two projects being considered are mutually exclusive

Q89: Lombardi Trucking Company has the following data:

Q102: Other things held constant, if a firm

Q119: Errors in the sales forecast can be

Q123: All else equal, a higher required rate