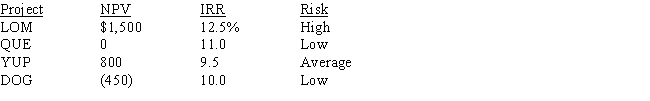

A college intern working at Anderson Paints evaluated potential investments⎯that is, capital budgeting projects⎯using the firm's average required rate of return (WACC) , and he produced the following report for the capital budgeting manager:  The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average, she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent, which one(s) should the capital budgeting manager recommend be purchased?

The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average, she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent, which one(s) should the capital budgeting manager recommend be purchased?

Definitions:

Afferent

Relating to or denoting nerve fibers that carry sensory information toward the central nervous system.

Central

Being at the most important or core position; of primary importance or relevance.

Sensory

Pertaining to the senses or sensation.

Afferent Nerves

Nerves that carry sensory signals from the body's periphery towards the central nervous system, including the brain and spinal cord.

Q13: Assume that the current yield curve is

Q17: Long-term bonds are more vulnerable to reinvestment

Q43: The dollar return earned on a debt

Q48: What is the present value of a

Q56: Given some amount to be received several

Q67: The beta of any portfolio can be

Q80: In a portfolio of three different stocks,

Q90: If the expected rate of return on

Q108: For bonds, price sensitivity to a given

Q113: A 15-year zero coupon bond has a