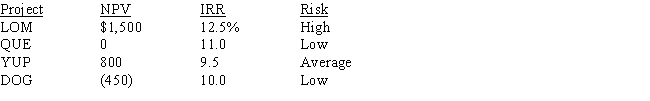

A college intern working at Anderson Paints evaluated potential investments⎯that is, capital budgeting projects⎯using the firm's average required rate of return (WACC) , and he produced the following report for the capital budgeting manager:  The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average, she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent, which one(s) should the capital budgeting manager recommend be purchased?

The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average, she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent, which one(s) should the capital budgeting manager recommend be purchased?

Definitions:

Diversity Training

Educational programs aimed at increasing participants' cultural awareness, knowledge, and skills to handle diversity within the workplace effectively.

Discrimination

Unjust or prejudicial treatment of different categories of people, especially on the grounds of race, age, or sex.

Heterosexuality

A sexual orientation characterized by a romantic or sexual attraction between people of the opposite sex.

Homophobia

A range of negative attitudes and feelings toward homosexuality or people who are identified or perceived as being homosexual.

Q12: A positive number in the retained earnings

Q18: A firm going from a lower to

Q20: Any capital budgeting investment rule should depend

Q29: The component costs of capital are market-determined

Q45: You have just taken out a 30-year

Q52: In the textbook, the nominal interest rate

Q55: When the federal government runs a deficit

Q73: Which of the following statements is correct?<br>A)

Q96: The greater the number of compounding periods

Q114: Culver Inc.has earnings after interest but before