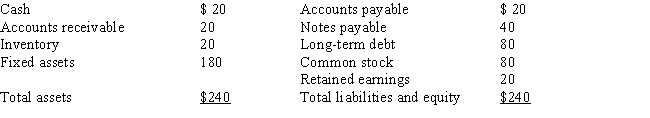

A firm has the following balance sheet:  Sales for the year just ended were $400, and fixed assets were used at 80 percent of capacity, but its current assets were at optimal levels.Sales are expected to grow by 5 percent next year, the profit margin is 5 percent, and the dividend payout ratio is 60 percent.How much additional funds (AFN) will be needed?

Sales for the year just ended were $400, and fixed assets were used at 80 percent of capacity, but its current assets were at optimal levels.Sales are expected to grow by 5 percent next year, the profit margin is 5 percent, and the dividend payout ratio is 60 percent.How much additional funds (AFN) will be needed?

Definitions:

Percentage Analysis

A financial analysis technique that involves expressing each item in a financial statement as a percentage of a base amount to assess the financial health and performance of a company.

Financial Statement

A formal record of the financial activities and position of a business, individual, or other entity, usually presented in a structured manner for a specific period.

Return On Total Assets

A profitability ratio that measures the profitability of total assets without considering how the assets are financed, computed as income plus interest expense divided by average total assets.

Profitability

A measure of how effectively a company generates profit from its revenues or assets.

Q26: The difference between the nominal risk-free rate

Q37: On its December 31st balance sheet, LCG

Q66: The Federal Reserve can change the level

Q67: Modular Systems Inc.just paid dividend D<sub>0</sub>, and

Q80: The deposits of federal credit unions are

Q86: Which of the following statements is correct?<br>A)

Q89: When considering stock and bond valuation models,

Q92: When a firm pays off a loan

Q96: The greater the number of compounding periods

Q99: To determine the amount of additional funds