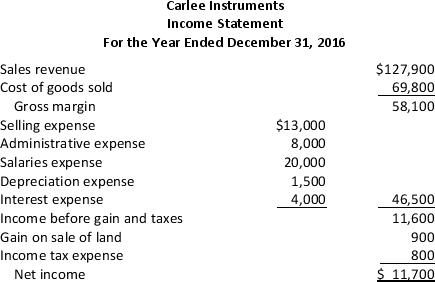

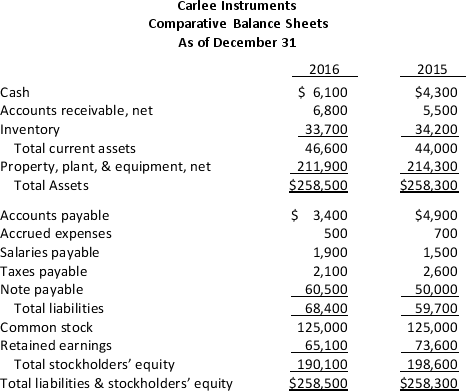

Alma Ortiz prepared Carlee Instruments' balance sheet and income statement for 2016.Before she could complete the statement of cash flows,she had to leave town to attend to a family emergency.Because the full set of statements must be provided to the auditors today,Carlee's president,Mike Lymon,has asked you to prepare the statement of cash flows.Lymon has provided you with the balance sheet and income statement that Ortiz prepared,as well as some notes she made:

Equipment with an original cost of $35,000 was sold for $20,300.The book value of the equipment was $19,400.

Equipment with an original cost of $35,000 was sold for $20,300.The book value of the equipment was $19,400.

On June 1,2016,the company purchased new equipment for cash at a cost of $18,500.

At the end of the year the company issued notes payable for $10,500 cash.The note will mature on December 31,2019.

The company paid $20,200 in cash dividends for the year.

Required:

Using the direct method,prepare Carlee Instruments' statement of cash flows for 2016.

Definitions:

Functional Currency

The currency of the primary economic environment in which an entity operates and carries out its transactions.

Presentation Currency

The currency in which financial statements are presented. This may differ from the functional currency in which transactions are recorded.

Accounts Receivable

Money owed to a company by its debtors for goods sold or services rendered on credit.

AASB 121

Specifies the requirements for accounting for foreign exchange rates and their effects on foreign currency transactions, including translation of foreign currency financial statements into the entity's presentation currency.

Q10: For the past two years,Monroe Corporation's statement

Q27: When using a process costing system,the formula

Q33: An investor purchased a call option that

Q41: On the cash flow statement,issuing new debt

Q49: In preparing cash flows provided by operating

Q50: ROI can be improved by<br>A)Increasing revenue.<br>B)Decreasing expenses.<br>C)Decreasing

Q58: Kimble Industries production division reported a net

Q89: Berry Corporation reported the following cash transactions

Q145: Gant Wholesale Company has $2,000 in cash,$7,000

Q159: If you think of an organization's structure