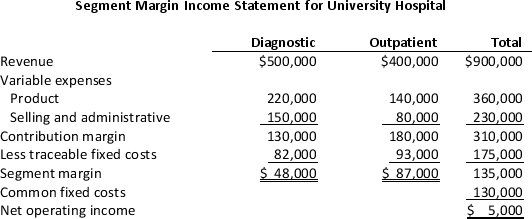

University Hospital provided the following income statement for two of its divisions: Diagnostic and Outpatient.Both divisions are structured as investment centers.

The average assets for Diagnostic and Outpatient divisions total $400,000 and $600,000,respectively.The required minimum rate of return for both divisions is 10%.

The average assets for Diagnostic and Outpatient divisions total $400,000 and $600,000,respectively.The required minimum rate of return for both divisions is 10%.

Required:

a.Calculate the current residual income for each division.

b.Why is residual income a better measure of performance for managers of investment centers than the overall profit compared to the flexible budget?

Definitions:

Sold Units

The total number of units of a product that have been sold during a specific period.

Break-Even Point

The point at which total costs and total revenues are equal, meaning there is no profit or loss, and initial investments begin to be recovered.

Dollar Sales

The total monetary value of sales transactions within a specific period, expressed in dollars.

Profit and Loss Statement

A financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a fiscal quarter or year, also known as an income statement.

Q17: Utica Corporation reported the following financial information:<br>

Q33: A strategy map<br>A)Is a visual display of

Q66: An investment center manager should be evaluated

Q84: In implementing an activity-based costing system,once the

Q86: Betty's Bakery needs to purchase a new

Q96: Even if an organization relies solely on

Q113: Leonora Industries manufactures light fixtures for home,retail,and

Q130: On January 4<sup>th</sup>,Stevens Manufacturing received an order

Q161: Managers use the capital budgeting techniques to

Q190: The most common measure used as the