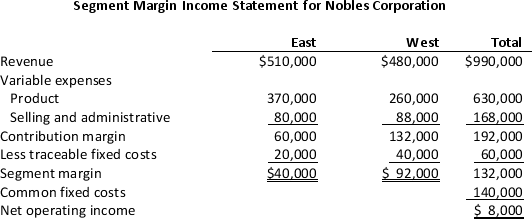

Nobles Corporation provided the following income statement for two of its divisions: East and West.

Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets $60,000 current and $240,000 long-term and $320,000 of liabilities $120,000 current and $200,000 long-term.The West division reported $360,000 of assets $80,000 current and $280,000 long-term and $260,000 of liabilities $60,000 current and $200,000 long-term.

Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets $60,000 current and $240,000 long-term and $320,000 of liabilities $120,000 current and $200,000 long-term.The West division reported $360,000 of assets $80,000 current and $280,000 long-term and $260,000 of liabilities $60,000 current and $200,000 long-term.

Required:

a.Calculate the economic value added for each division.

b.Which of the two managers will be rated higher on performance? Why?

Definitions:

Temptation of Fraud

The allure or inclination to engage in deceptive practices for personal or organizational gain.

Cultural Norms

Shared expectations and rules that guide behavior of people within social groups.

Inflated Expectations

Describes heightened or unrealistic anticipations about a situation, product, or event that may lead to disappointment when not met.

Organizational Ethics

Refers to the principles, values, and standards that guide behavior within the context of a business or organization, determining its conduct and decision-making processes.

Q20: Burton Corporation's Central region operates an investment

Q24: Assume that on January 1,2014 you purchased

Q35: Mountaineer,Inc.currently makes 6,000 pairs of weatherproof hiking

Q67: When using the balanced scorecard to monitor

Q95: Which of the following is an advantage

Q114: Which of the following strategies relate to

Q122: The Transformer division of Lorman Industries produces

Q135: Net operating profit after taxes is referred

Q136: In the activity identification stage of implementing

Q140: Common costs,those not directly caused by the