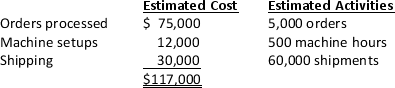

Jones Manufacturing Company makes two products.The company's budget includes $500,000 of overhead.In the past,the company allocated overhead based on estimated total direct labor hours of 20,000.Jones recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: processed purchase orders,machine setups,and good shipped.The following is a summary of company information:

Required:

Required:

a.Calculate the company's overhead rate based on total direct hours.

b.Calculate the company's overhead rates using the activity-based costing pools.

Unit 7-2,

Definitions:

Alfalfa

Alfalfa is a perennial flowering plant often used as forage for livestock due to its high nutrient content and adaptability to various climates.

Comparative Advantage

The ability of an individual or group to carry out a particular economic activity more efficiently than another activity.

Import

The purchase of goods or services from foreign producers, bringing them into one's home country.

Export

The sale of goods or services produced in one country to another country, contributing to a nation's gross domestic product.

Q20: Ayala Inc.computed an overhead rate for machining

Q31: Nora,Inc.manufactures components used by a major cell

Q33: Which of the following is not a

Q40: Which of the following is the step

Q48: Custom Design manufactures baby blankets by turning

Q57: Flexible budgets are used as a tool

Q65: Custom Design manufactures t-shirts for new parents

Q67: In an environment where the there is

Q82: Danny's Delights is a wholesale bakery.Danny makes

Q147: A costing technique that assigns costs to