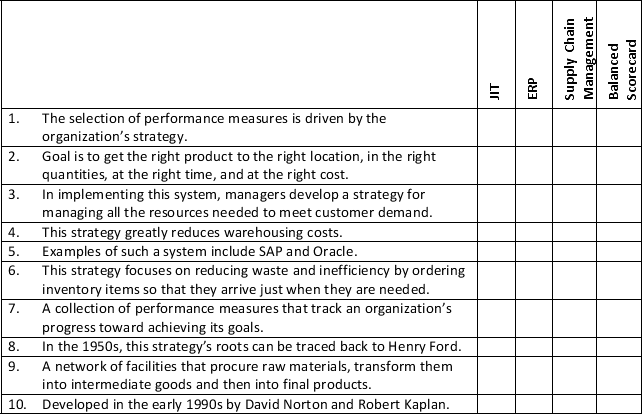

For each statement below,indicate the management tool being implemented.

Definitions:

Deferred Income Tax Liability

A tax obligation recorded on the balance sheet that refers to taxes that are due in the future due to temporary differences between the financial accounting and tax reporting.

Pre-Tax Book Income

The income of a company before taxes have been deducted, as recorded in the accounting records according to standard accounting practices.

Tax Depreciation

The depreciation expense allowed by taxation authorities that enables a taxpayer to recover the cost of property or assets.

Book Depreciation

The systematic allocation of the cost of a tangible asset over its useful life for accounting and tax purposes.

Q28: One way to compute the expected change

Q41: Chocolate Delight sells chocolate dipped fruit to

Q42: Tax avoidance is a legal means to

Q51: Explain the flow of a product through

Q52: Your [level of education | age] will

Q58: The Robertsons,a couple with an adjusted gross

Q60: Your auto loan payments would be listed

Q82: Barbara's Boutique wants to know what it

Q132: In order to minimize the difficulty associated

Q133: Assume total fixed costs of $160,000,variable costs