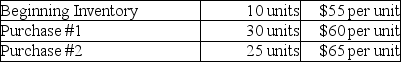

Carboni Company had the following data available for the current month:

Assume 40 units were sold during the month.Sales Revenue for the month is $7,000 and operating expenses are $2,200.The income tax rate is 30%.

Assume 40 units were sold during the month.Sales Revenue for the month is $7,000 and operating expenses are $2,200.The income tax rate is 30%.

Required:

1.Compute Cost of Goods Sold using:

a.FIFO

b.LIFO

2.How much would Carboni Company save in income taxes if they used LIFO instead of FIFO?

Definitions:

Employee's Supervisor

The person in charge of overseeing and guiding the performance and duties of employees within an organization.

Mental Imagery

Mental imagery involves the representation and simulation of sensory experiences in the mind, without external input, often used for creativity, problem-solving, or rehearsal.

Potential Obstacles

Foreseeable challenges or barriers that may impede progress or success.

Mental Imagery

The ability of individuals to simulate or recreate visual perceptions and experiences in their minds without the input of external stimuli.

Q5: The bookkeeper recorded a payment on account

Q8: Morgan Oaks Company replaced the windshields and

Q17: Given the following data,calculate the Cost of

Q19: The following data are for Steve's Candy

Q34: Under cash-basis accounting,cash receipts are treated as

Q84: In a bank reconciliation,an EFT cash payment

Q129: Which of the following is a CORRECT

Q138: On January 1,2015,Centre Company purchases $100,000,6% bonds

Q172: Unearned Service Revenue is a revenue account.

Q180: At the end of its useful life,the