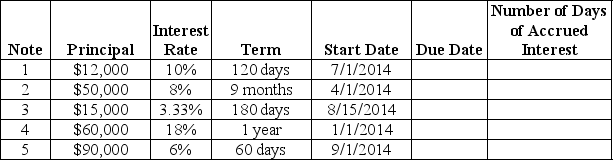

For each of the following independent notes,determine: (1)the due date of the note,(2)the number of days of accrued interest assuming a fiscal year end of September 30,2014 and (3)the amount of interest expense for each note at September 30,2014.Use 365 days for a year.

Definitions:

Contorted Look

A facial expression that shows twisting or distorting the face, often due to intense emotion.

Hallucination

A perception in the absence of sensory stimulation that is confused with reality.

Environmental Causes

Factors in one's surroundings that contribute to the onset of health conditions or diseases.

Sociocultural Causes

Factors in society and culture that influence the behavior, beliefs, and psychology of individuals.

Q35: When preparing a cash budget,a company must

Q37: For good internal control:<br>A)the purchasing agent should

Q68: Mary Smith Company has the following information

Q90: A company has $23,000 in cash and

Q103: On August 1,the Savage Company purchased $2,000

Q125: The first step in recording a transaction

Q136: Emma Jones Company has the following information

Q137: The dollar amount for Accounts Receivable in

Q141: To compute ending Retained Earnings on the

Q178: The revenue principle determines when to record