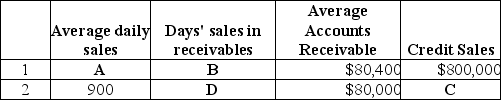

Complete the following chart by filling in the missing items.Use a 365-day year.

Definitions:

Bombing Raid

A military attack involving the dropping of bombs from aircraft.

Plane

Refers to a fixed-wing aircraft that is propelled forward by thrust from a jet engine or propeller.

Crew Members

Individuals who form part of a team working together on an aircraft, ship, or spacecraft, performing specific roles and responsibilities.

Personality Disorders

Types of mental disorders characterized by enduring maladaptive patterns of behavior, cognition, and inner experience, exhibited across many contexts and deviating from those accepted by the individual's culture.

Q28: The direct write-off method for uncollectible accounts

Q32: CBS Corporation acquired a patent for $1,000,000.The

Q64: Under the periodic inventory system:<br>A)the Inventory account

Q75: On December 1,Macy Company sold merchandise with

Q97: To account for the disposal of a

Q110: Service entities report Cost of Goods Sold

Q111: Gains on the sale of equipment increase

Q120: Which of the following items would NOT

Q131: What journal entry is prepared for a

Q176: Lori's Bath Supplies has the following Trial